Fabulous Info About How To Buy Index Futures

1) underlying index (spot) = nifty50.

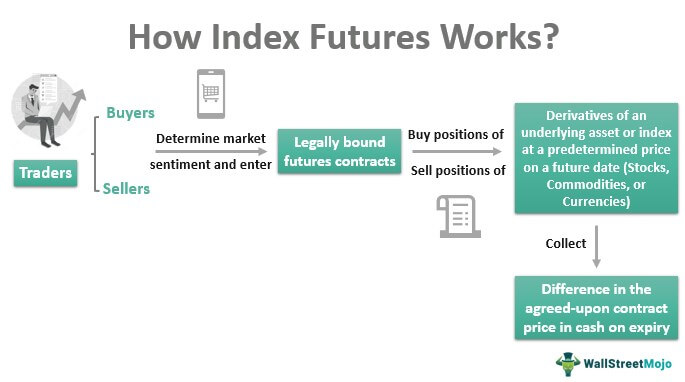

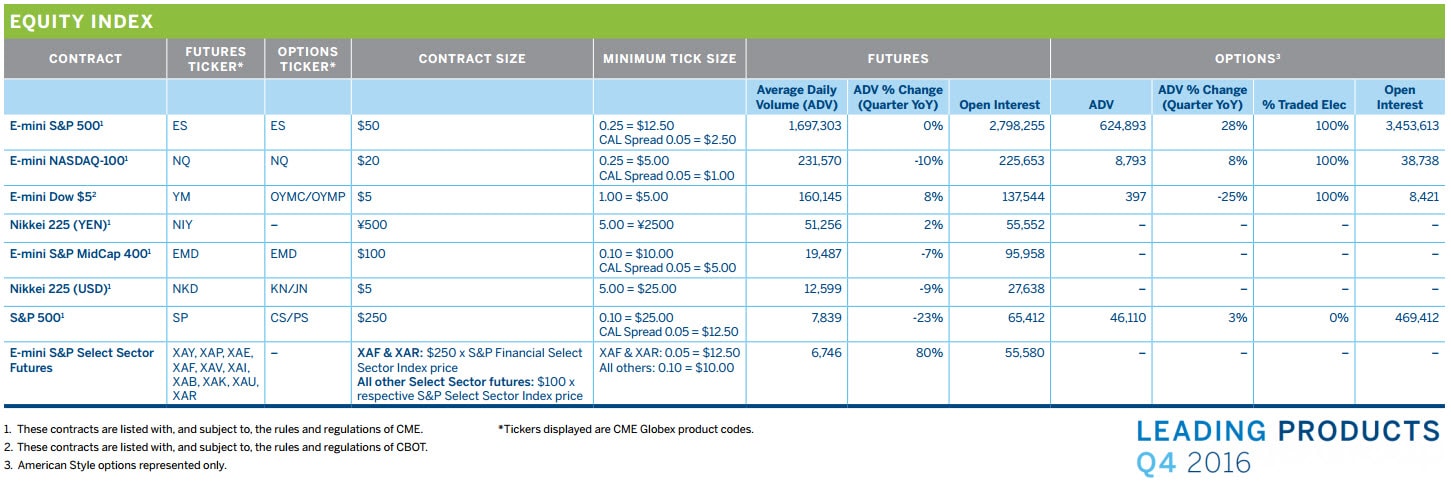

How to buy index futures. Index futures are traded on the chicago mercantile exchange globex and can be accessed through your broker if they offer index futures trading. Futures buying value = 4,00,000 * 10% futures buying value = rs. Index futures are futures contracts where a trader can buy or sell a financial index today to be settled at a future date.

Fair value, while s&p 500 futures gave up 0.5%. Index futures work like any other futures contract, with the underlying asset the contract is based on being a market index.in a futures contract, two parties agree to buy or sell. It is a legally binding agreement between a buyer and a seller that allows traders to buy or sell a contract on.

Ad trade with the futures platform awarded for 15 consecutive years. This is where the futures markets come in. Futures buying value = future contract value * margin required.

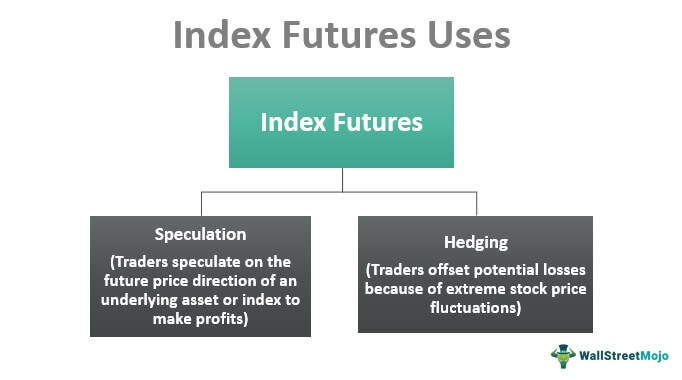

Pricing stock index futures stock index futures cannot be expected to trade at a level that is precisely aligned with the spot or cash value of the associated stock index. That asset might be soybeans, coffee, oil, individual stocks, exchange. The investor speculates on the future price movements of the stocks.

Deposit margin money with your broker. If the market moves in our favor and hits the order, we make a profit of $3,300 ($12.50 per tick x 264). One popular futures trading broker is ninjatraderbrokerage.

Futures look into the future to. So if you buy when the index itself is at 29,000, and sell when. The margin money for your contract is the amount of money required to open the position (essentially, to purchase the contract).

/futures-contract-4195880-01-final-02f6e035093b402fa53b5ade43f0760a.png)

/Futures_final-1113dde1485f4dc9ab4a8c0efc427700.png)