Great Tips About How To Develop A Cash Budget

How to prepare a cash budget step 1:

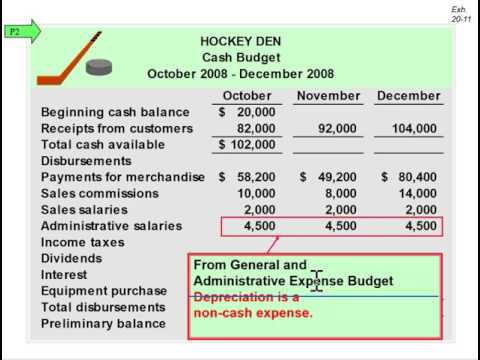

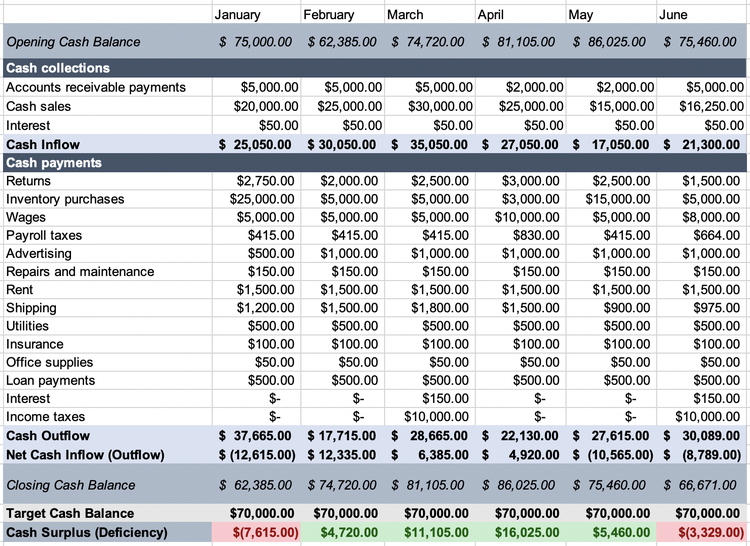

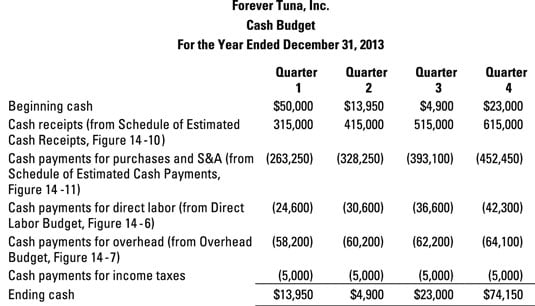

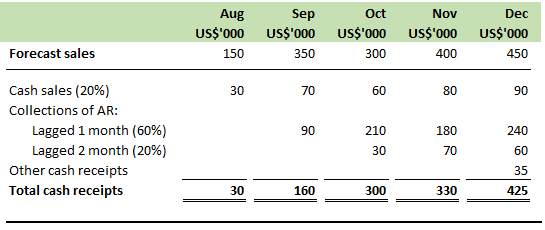

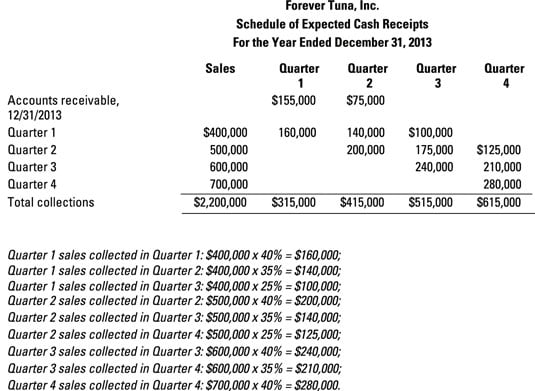

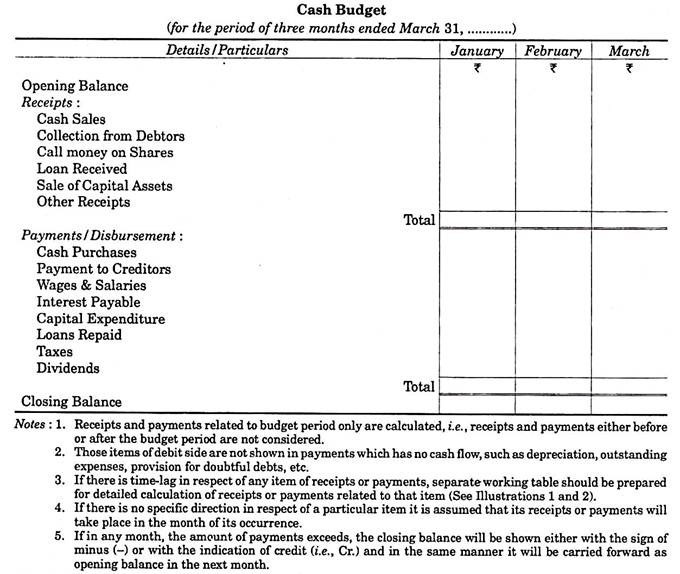

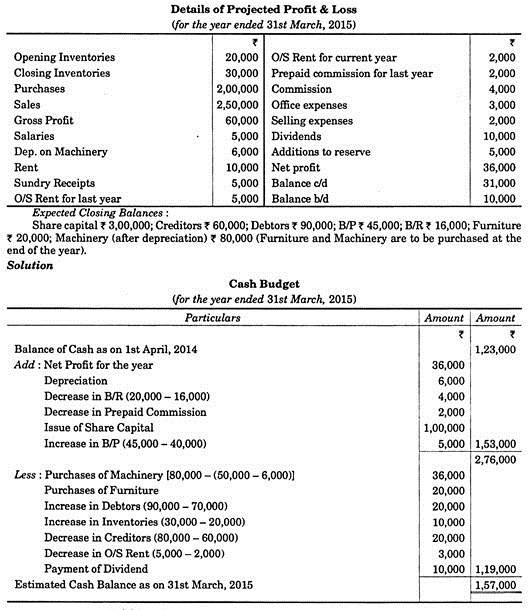

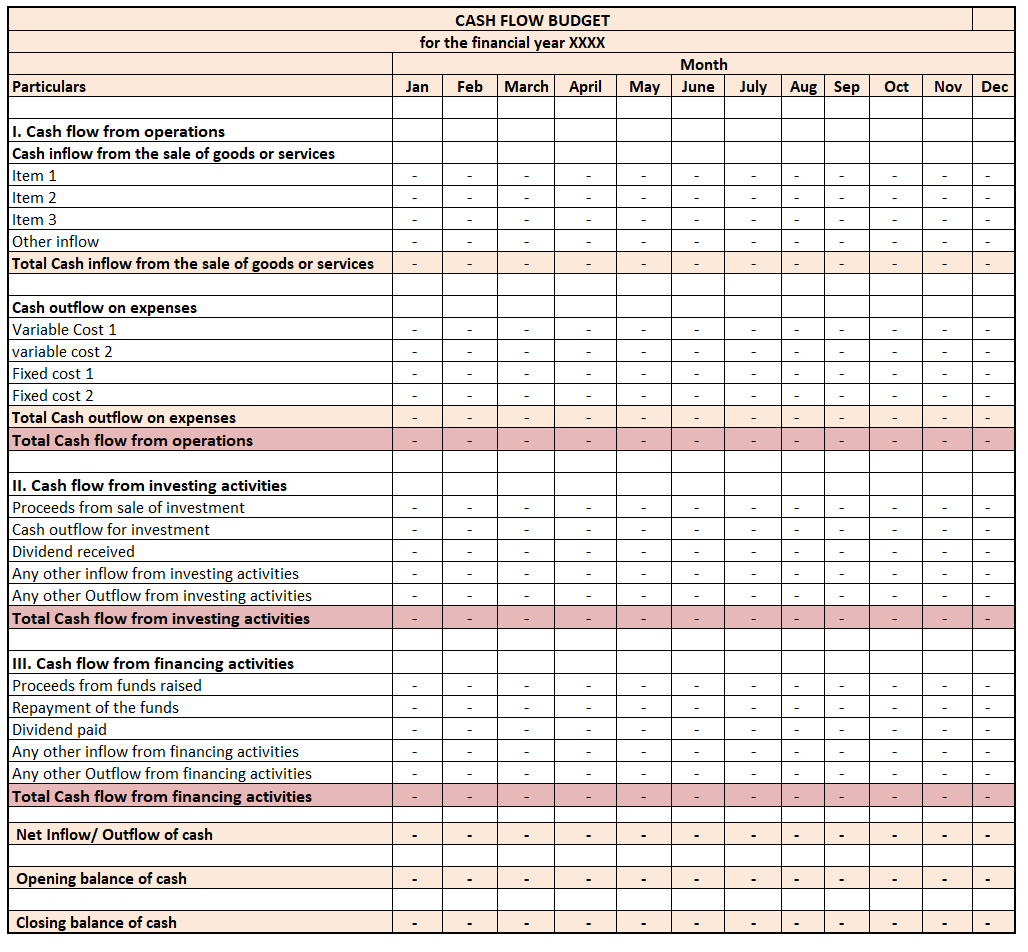

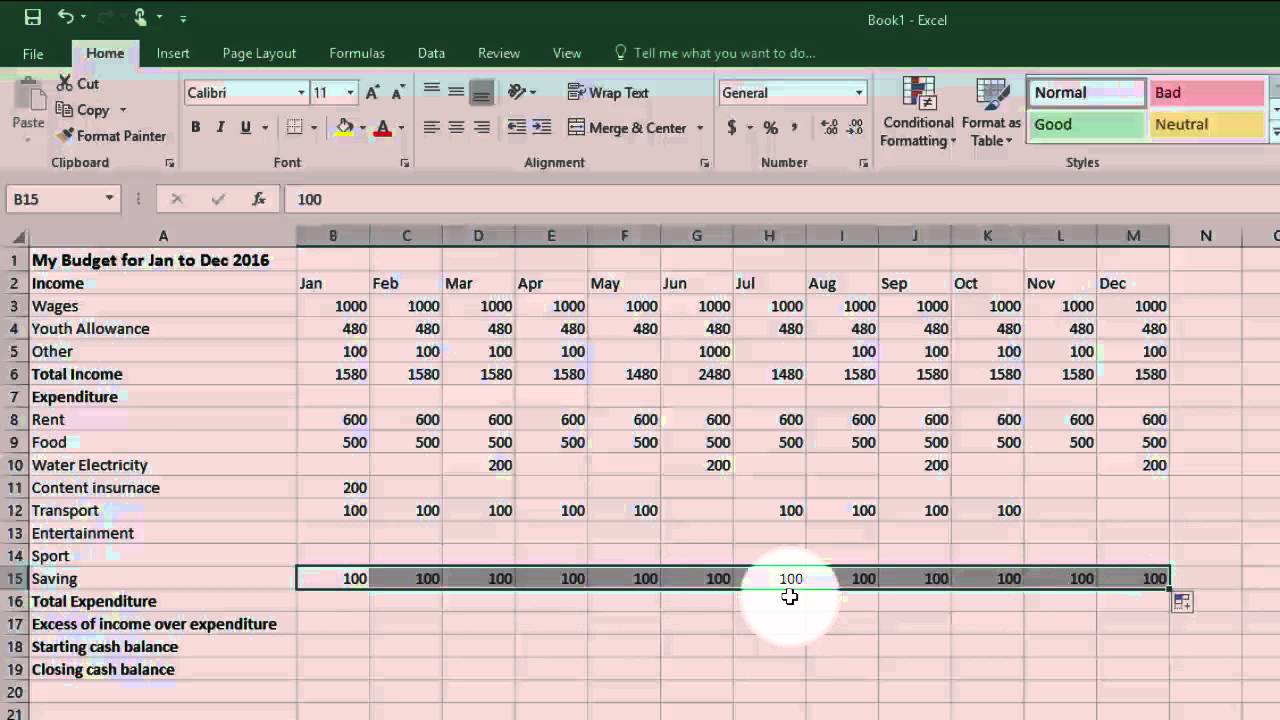

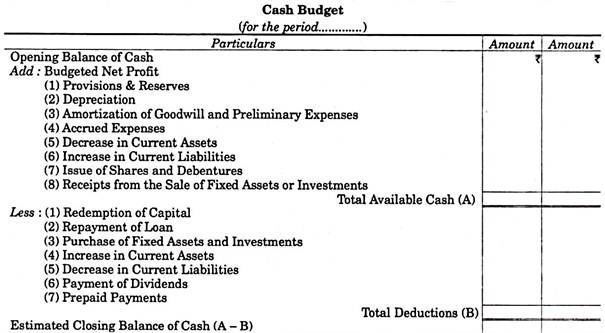

How to develop a cash budget. The resulting number shows how. 7 steps to create a cash flow budget 1. Some businesses still use spreadsheets to do manual calculations and generate cash flow statements.

Then add whatever lines you need for that. Common processes include communication within. How to analyze a cash budget [ top] the.

Some of these flows will be predictable, such as rent. This type of cash flow analysis is called cash budgeting preparation and analysis. Here’s how to create a budget in five steps.

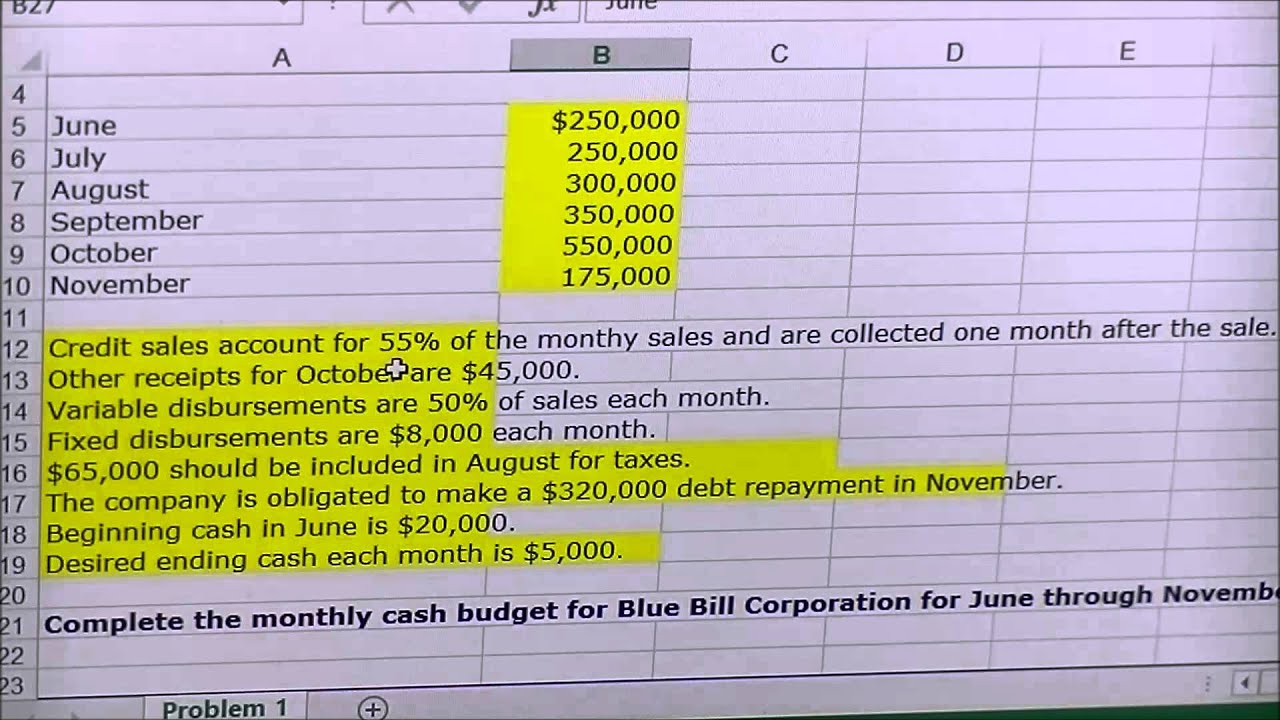

Use the spreadsheet calculator to add up all the starting capital and cash from revenue and then subtract the costs and expenses. There are three components to the process of developing a cash budget: How to create a budget calculate your net income list monthly expenses label fixed and variable expenses determine average.

Time period—the amount of time for which you are developing the budget desired cash. If the data is available,. The first step to creating a cash budget is to establish reliable forecasts of the company's cash inflows and outflows.

A cash budget is essential to. Starting from the initial planning stage, the company goes through a series of stages to finally implement the budget. Determine the cash inflow to the company in a month.