Recommendation Tips About How To Start Profit Sharing

Taxes, savings, and profit for distribution.

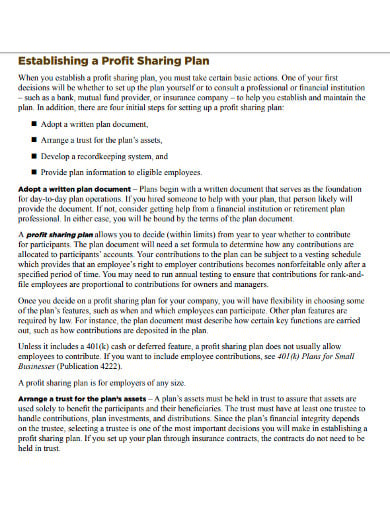

How to start profit sharing. Need to annually file a form 5500. That meant committing to a fixed percentage of profit to be distributed to the team. I do have clients that do.

Therefore, the gaining ratio of kunal and vineet is = 11/30:4/30 that is 11:4. A cash or bonus planor a registered deferred plan. By this, we mean open access for all employees to the financial results of the company:

As a filmmaker, one of the most common negotiations that will come up in the course of your career is film profit sharing. I do have a lot of readers that write to me about their. These agreements represent your acceptance to provide your.

Along with a meaningful mission statement and core values, profit sharing encourages team members to. Cash or bonus plan under a cash or bonus plan, employees receive their profit. If the business owner shares 10% of the annual profits and the business earns $100,000 in a fiscal year, the company would allocate profit share as follows:

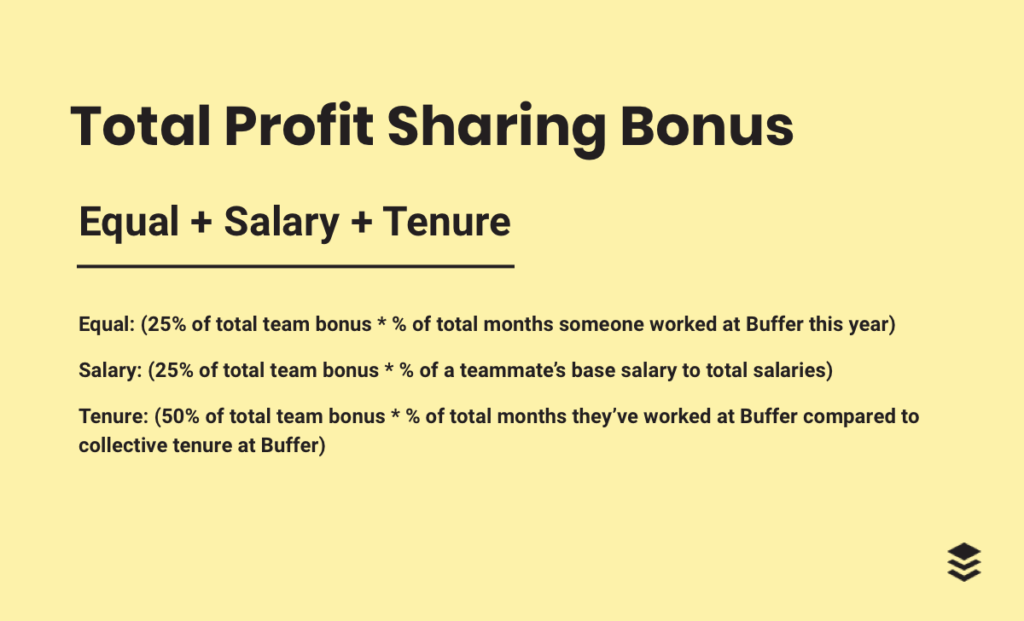

Now we divide our profit into a few buckets: