Who Else Wants Info About How To Start Buying A Home

Ad home ownership can be rewarding.

How to start buying a home. After the designs and blueprints have been finalized and your permits have been approved, that’s when construction starts and your home begins to. Get your finances in order, 3. Here are the big ones:

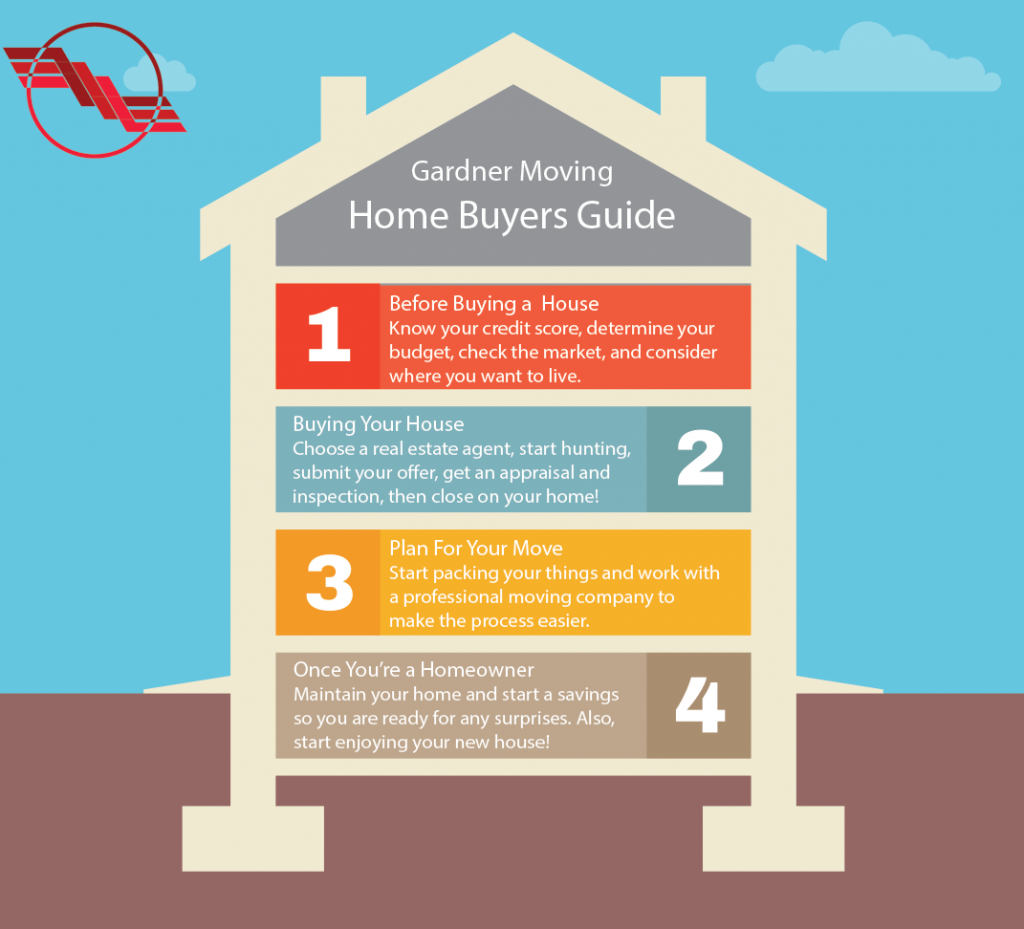

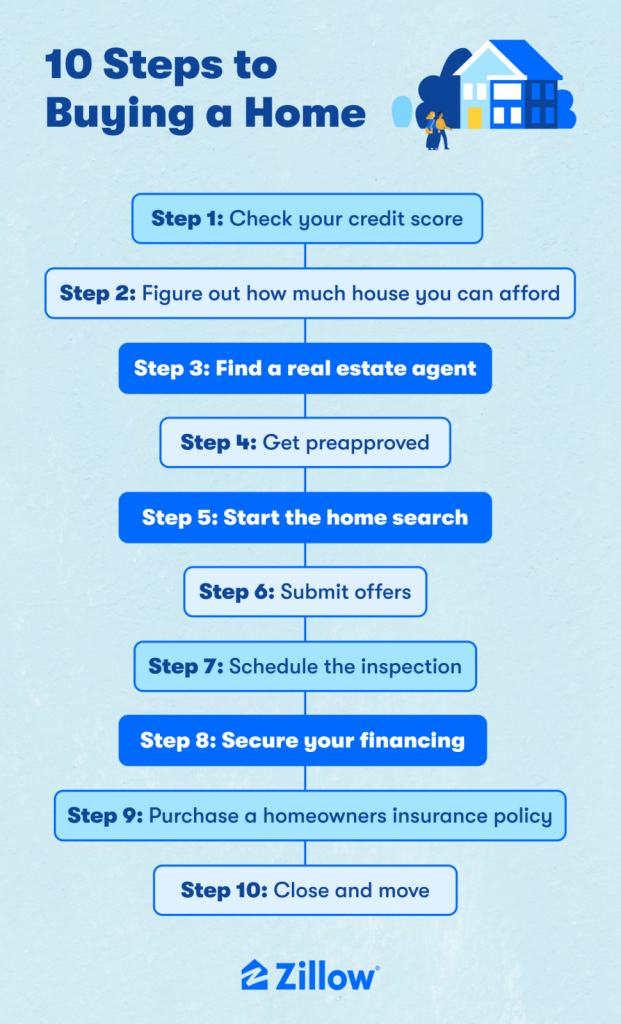

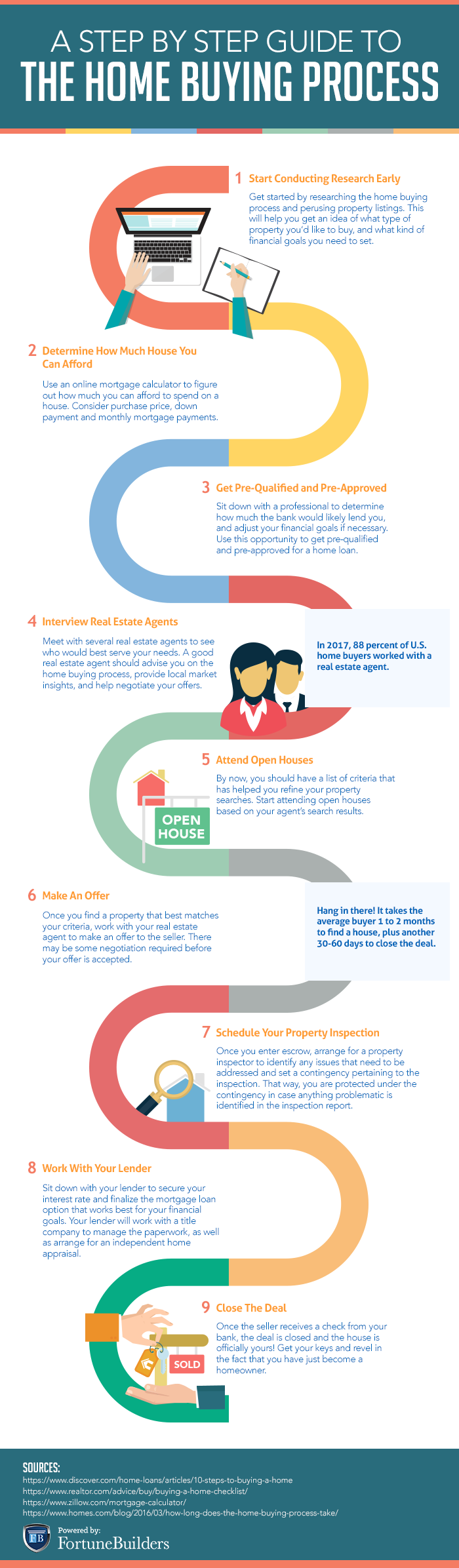

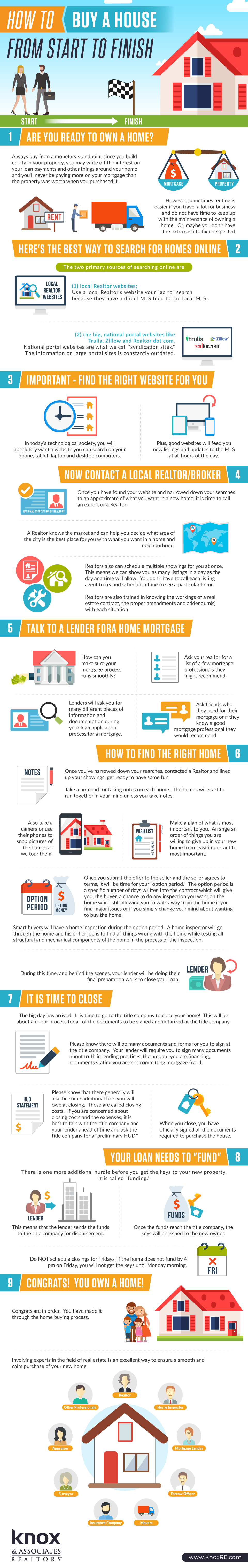

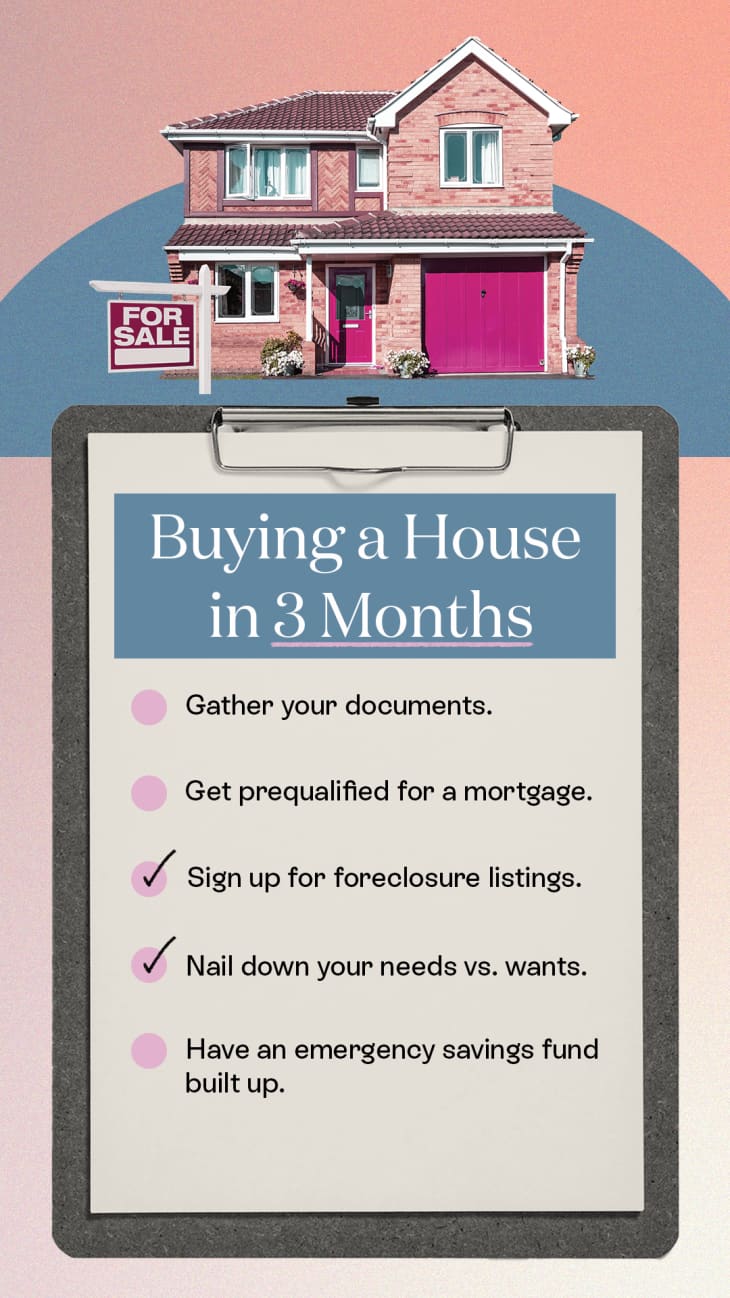

Most buyers will require a mortgage in order to purchase a home. The first step to buying a home is to learn what kind of ground you’re standing on from a lender’s perspective — and that means knowing your credit score. The template will include your offer price, down payment amount, earnest money deposit, contingencies, and desired closing date.

Here is a list of our partners and here's how we make money. First discover each step of the home buying process. Before you start looking for a new home, you should have an idea of how much you can afford to spend on a property.

Ad find out why 95% of closed clients would recommend us. Trusted va loan lender of 300,000+ veterans nationwide. While putting 20% down is known to be the standard amount for a down payment when buying a home, there are other.

You'll know your budget — you don’t want to find your perfect home only to discover you can’t afford it. Save for your down payment and closing costs. Research and hire the building team.

Budget your cash strictly, and put the savings in your home account. Understand the process of building a house. As soon as you can, start reading web sites, newspapers, and magazines that have real.

![Nestiny Funiversity - 18 Steps Of The Homebuying Process [Infographic]](https://resource.nestiny.com/resources/images/IMG_Steps-of-the-home-buying-process.png)